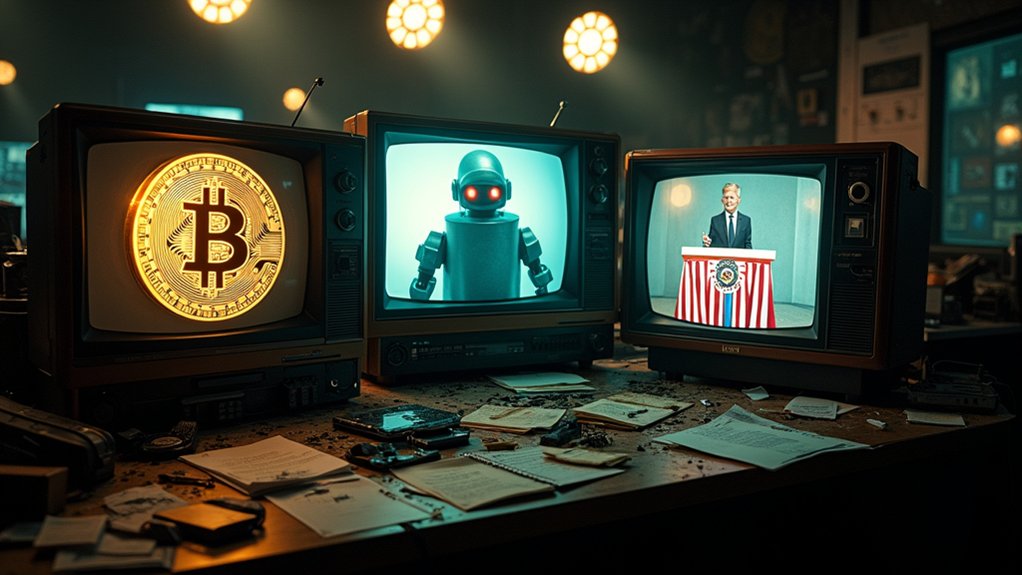

The entrenched skepticism exhibited by Wall Street’s Old Guard toward cryptocurrencies, rooted in concerns over extreme price volatility, fragmented regulatory frameworks, and perceived cultural dissonance between traditional finance and crypto-native innovation, underscores a profound institutional hesitancy that manifests not only in cautious market participation but also in circumspect strategic posturing, as legacy financial institutions grapple with integrating nascent digital assets within established risk management paradigms, compliance obligations, and business models while contending with uncertainties surrounding the legitimacy, regulatory acceptance, and long-term viability of crypto as a productive asset class rather than mere speculative instruments. This reticence is further exacerbated by a pronounced legacy bias that inclines traditional financiers to favor established asset classes with extensive historical data and proven regulatory clarity over novel digital instruments whose legal frameworks remain both fragmented and evolving. Regulatory hesitation, consequently, pervades institutional attitudes, as regulatory ambiguity and inconsistent enforcement across jurisdictions amplify perceived compliance risks, particularly regarding anti-money laundering (AML) and know-your-customer (KYC) mandates, thereby impeding the scaling of crypto exposure among risk-averse market participants. Moreover, the launch of traditional Wall Street-style funds by crypto firms reflects a cautious yet emerging pathway for institutional adoption that seeks to bridge this gap through familiar investment vehicles launch of institutional funds. Industry leaders like Peter Karl of Cantor Fitzgerald emphasize ongoing efforts to drive institutional adoption through substantial capital raises and partnerships such as with Tether, illustrating this gradual shift toward acceptance of crypto assets within traditional financial frameworks institutional adoption.

Moreover, the cultural and generational divide separating crypto-native innovators from seasoned financial executives entrenches skepticism, as the former’s disruptive ethos and technological paradigms clash with the latter’s prudential emphasis on capital preservation and regulatory conformity. Incumbent institutions, conditioned by decades of oversight under stringent regulatory regimes, view cryptocurrencies predominantly through a lens of reputational risk and speculative volatility rather than as legitimate stores of value or productive assets, a perception intensified by crypto’s historical associations with illicit activities and episodic market manipulation. Consequently, traditional asset managers remain cautious, awaiting the maturation of institutional-grade products such as exchange-traded funds and tokenized funds that can seamlessly integrate with existing portfolio and risk management infrastructures. The absence of robust custody, settlement, and auditing mechanisms, alongside nascent decentralized finance (DeFi) engagement, further compounds institutional reluctance, reflecting a broader strategic ambivalence that tempers large-scale adoption despite incremental legislative clarifications like the Guiding and Establishing National Innovation for U.S. Stablecoins Act. Furthermore, regulatory agencies such as the SEC, CFTC, and FinCEN continue to define and enforce compliance standards, shaping institutional willingness through their evolving interpretations and requirements around digital assets and crypto custody. Hence, the interplay of legacy bias and regulatory hesitation continues to circumscribe Wall Street’s Old Guard engagement with cryptocurrency markets, underscoring a persistent institutional conservatism amid an evolving digital asset landscape.