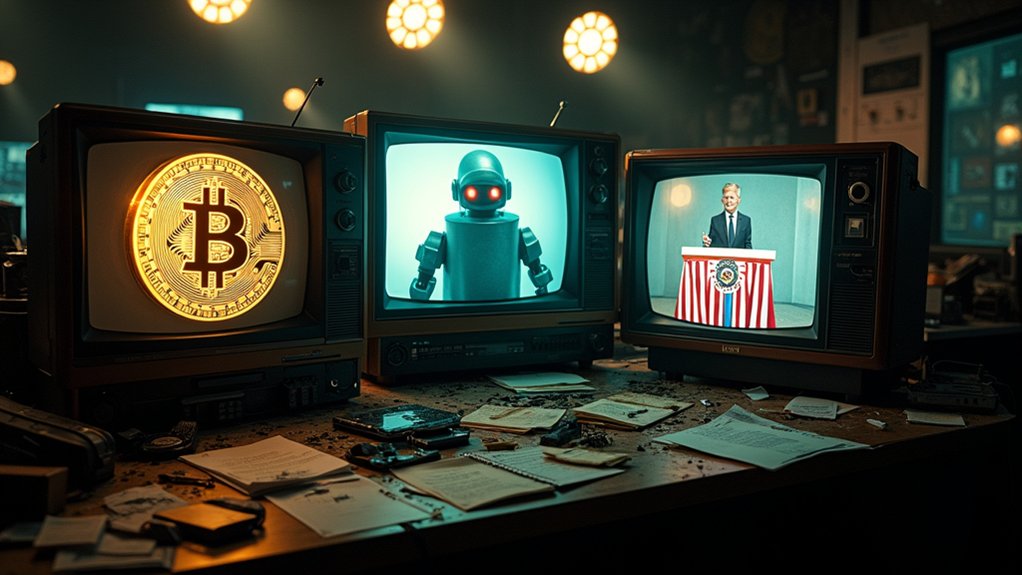

While the broader cryptocurrency market feigns resilience, the recent DOGE selloff ruthlessly exposed the fragility lurking beneath inflated valuations, as a near 10% price plunge triggered cascading liquidations and amplified volatility, mercilessly dragging down heavyweight tokens like BTC and ETH in its wake; this episode not only underscores the reckless herd mentality fueled by speculative leverage but also spotlights the glaring absence of robust risk management and regulatory clarity, leaving investors to grapple with a market that punishes overconfidence and rewards institutional maneuvering with ruthless efficiency. The selloff, marked by two staggering volume spikes dwarfing the 24-hour average, laid bare the pernicious role of whale movements, as massive accumulations near the $0.19 support level stabilized prices only after the damage was done, revealing an unsettling choreography where institutional players capitalize on panic-induced price dislocations. Regulatory impact looms large over this turmoil; heightened uncertainty surrounding crypto ETF approvals exacerbated market anxiety, intensifying sell pressure and underscoring the dire consequences of opaque and inconsistent enforcement regimes that leave retail investors exposed and vulnerable. The liquidation imbalance was nothing short of catastrophic, with long positions liquidated at rates 1000% greater than shorts, a brutal testament to the reckless leverage that continues to plague this market. This chain reaction not only drained liquidity but also sparked a profit-taking frenzy that cascaded across altcoins, pulling down SOL and XRP alongside Bitcoin and Ethereum, further unraveling already tenuous confidence. Despite a resilient bounce above $0.20, DOGE’s gyrations vividly illustrate a speculative asset caught in the crosshairs of regulatory ambiguity and predatory institutional tactics, serving as a stark warning that in this market, volatility is weaponized, risk management is an afterthought, and only the nimble and well-capitalized survive. Notably, over $590,000 in long positions were liquidated during this rapid price decline, highlighting the scale of liquidations that exacerbated market instability. Given Dogecoin’s current price near $0.17 and its rank as the No. 8 cryptocurrency, this selloff reverberates significantly across the broader market sentiment. This episode also reveals how digital currencies’ reliance on blockchain systems can amplify both transparency and vulnerability during periods of extreme market stress.

Author

Tags

Share article

The post has been shared by 0

people.