Looming over the financial world like a storm cloud, the sentencing of Alex Mashinsky, ex-CEO of Celsius Network, is set for May 8, 2025, after a slight delay from its original April date. His lawyers begged for extra time to craft a “comprehensive sentencing submission,” and though prosecutors grumbled, the court nodded yes. Imagine the tension in that courtroom—air thick with anticipation, the faint scratch of pens on paper as victims’ stories pile up. Over 200 impact statements paint a grim picture of lost savings and shattered dreams, like one investor’s vanished retirement fund or another’s 1.5 Bitcoin, gone in a digital puff of smoke.

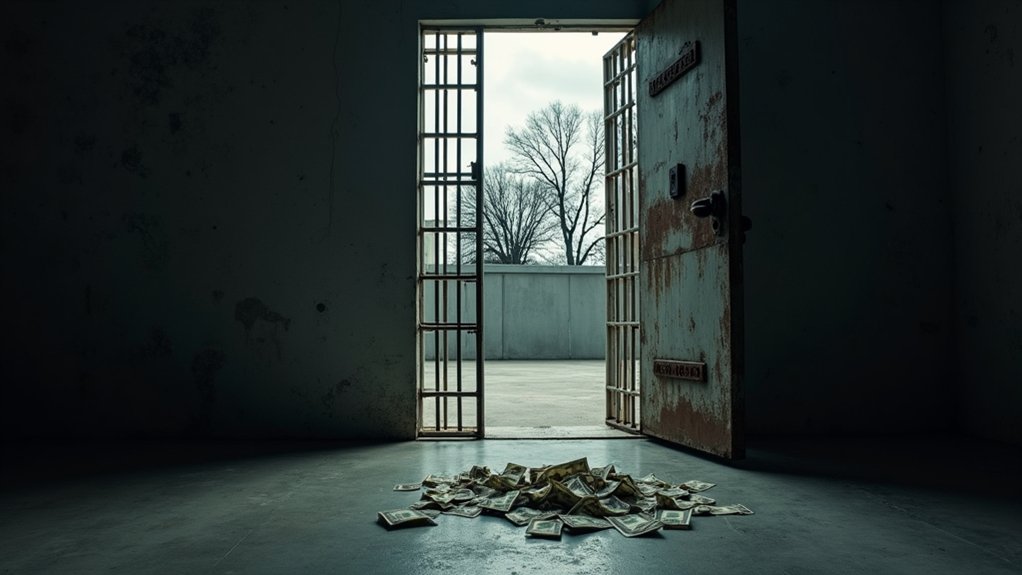

Now, Mashinsky’s guilty plea on December 3, 2024, to commodities and securities fraud isn’t just a legal footnote—it’s a gut punch. He admitted to duping customers about Celsius’s “Earn” program and messing with the CEL token price while secretly cashing out his own stash. A multi-billion dollar fraud scheme, they say. Picture him pitching Celsius as safer than old-school banks, all while playing risky games with customer cash behind closed doors. It’s the ultimate irony: a fintech guru, heralded as a modern money wizard, caught in a scandal as old as greed itself. This deception led to a staggering deficit of $1.2 billion deficit of $1.2 billion during the company’s collapse, leaving countless investors in financial ruin. Like many classic Ponzi scheme tactics, Mashinsky used new investor deposits to pay earlier participants while maintaining an illusion of profitability.

Mashinsky’s guilty plea to fraud is a gut punch, exposing a fintech wizard’s multi-billion dollar deception behind Celsius’s false promises of safety.

Facing up to 30 years in prison, Mashinsky’s fate hangs heavy. His team pleads for just a year and a day—barely a slap on the wrist—while probation officers push for 15 years, and victims? Many scream for life behind bars, though some soften if stolen funds magically reappear. The contrast is stark: high-tech promises of wealth versus the cold, hard reality of loss. One can almost hear the judge’s gavel hovering, a sound waiting to echo through Wall Street’s glass towers. The collapse of Celsius in 2022, following the Terra implosion, sent shockwaves through the crypto industry, amplifying calls for accountability Terra implosion shockwaves.

And while Roni Cohen-Pavon, Celsius’s ex-revenue chief, flips to help prosecutors, civil lawsuits from the SEC and others swirl like vultures. Celsius itself settled for $4.7 billion with the FTC, banned from touching consumer assets. Will justice feel like a fresh breeze or a bitter chill come May? Only time, and that courtroom, will tell.