A Massachusetts Appeals Court has ruled in favor of Santander Bank in a case that highlights the limited responsibility banks bear for customer cryptocurrency losses.

Lourenco Garcia, who lost a staggering $751,500 to the fraudulent crypto platform CoinEgg, walked away empty-handed after judges determined the bank had no obligation to prevent his authorized transactions—despite their suspicious nature.

The ill-fated transfers occurred during a three-week period bridging 2021 and 2022, when Garcia initiated multiple transactions including debit card purchases through Crypto.com and seven separate wire transfers.

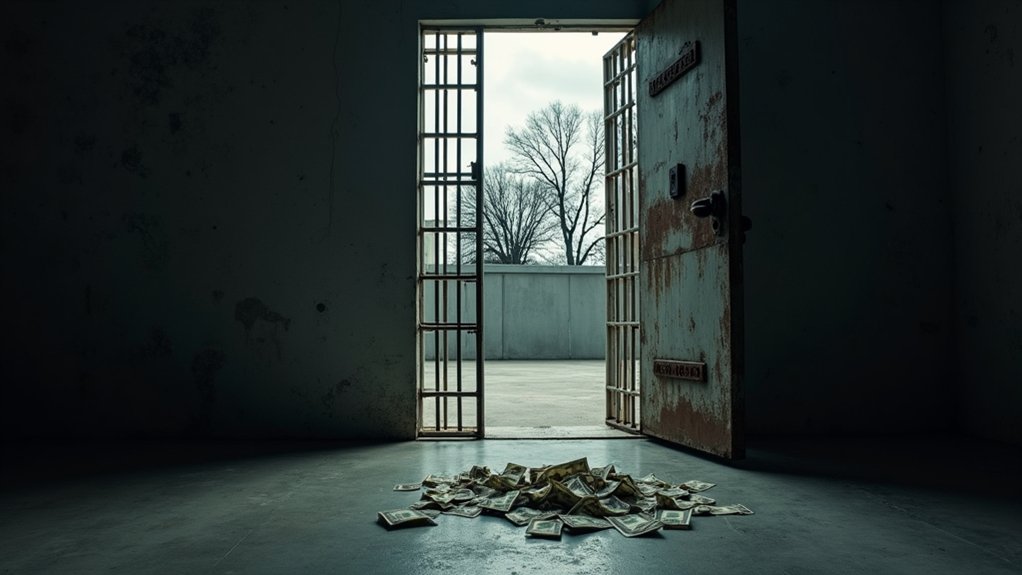

The funds vanished like morning mist, leaving behind only digital footprints and a profound sense of betrayal.

Garcia’s lawsuit claimed Santander should have recognized the red flags waving frantically above these transactions.

His fingers pointed to the bank’s own marketing materials, which boasted about fraud monitoring and customer notifications.

“They promised to be vigilant,” one could imagine him arguing, while bank representatives shuffled uncomfortably in their seats.

The court, however, remained unmoved by this reasoning.

In their view, Santander’s customer agreement contained no promise to block authorized transactions, regardless of how suspicious they might appear.

The judges deemed the bank’s website language about fraud monitoring as mere marketing—colorful promises with no binding legal weight.

At the heart of the ruling lies a fundamental principle: banks aren’t financial guardians against scams involving transactions that customers themselves authorize.

The Legal Bitcoin News reported that the court confirmed Santander Bank was not liable for the customer’s crypto losses.

The cold reality of Authorized Push Payment fraud crashed against Garcia’s expectations like waves against an unyielding cliff.

Financial Crimes Enforcement Network regulations require strict compliance from crypto exchanges, but traditional banks operate under different guidelines for customer-authorized transfers.

This case emerges against a backdrop of exploding cryptocurrency scams, with losses skyrocketing by over 6,000% in early 2025 compared to the previous year.

As digital assets continue their march into mainstream finance, the legal landscape struggles to keep pace with evolving threats.

The legal process spanned two full years with decisions consistently favoring Santander in both Superior Court and appeals court proceedings.

For now, the message rings clear as a bell: when it comes to cryptocurrency transfers, customers stand alone at the precipice, with banks safely watching from a legally protected distance.