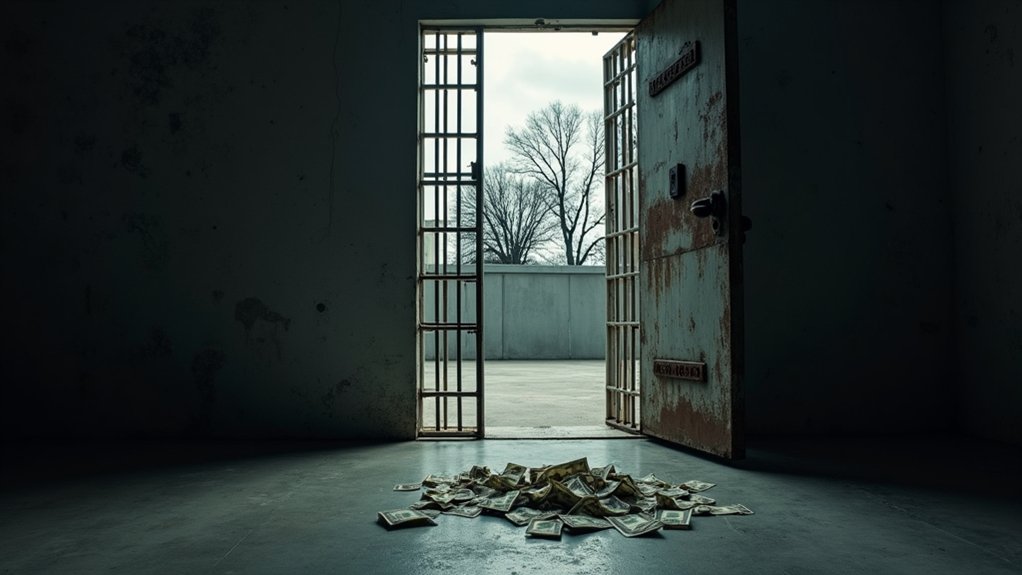

While Donald Trump’s latest executive orders promise to catapult the U.S. into a crypto superpower, the glaring conflicts of interest tied to his family’s $2 billion foreign crypto deal expose a festering hypocrisy that demands scrutiny. On January 23, 2025, Trump signed an order to turbocharge digital assets and blockchain, even appointing David Sacks as “Crypto and AI Czar” to helm a high-powered Working Group. Yet, while he postures as crypto’s champion, the stench of self-interest lingers, as his family’s shady deal with a foreign government threatens to derail bipartisan stablecoin laws. Is this leadership or a leveraged grift?

Dive deeper, and the audacity sharpens. Trump’s March 6, 2025, order established a Strategic Bitcoin Reserve, hoarding 207,000 Bitcoins worth $17 billion, mimicking gold stockpiles while the Treasury scrambles for more under “budget-neutral” pretenses. Meanwhile, Congress, once inching toward clarity with the GENIUS Act for stablecoin oversight, now stumbles, paralyzed by Democrats’ outrage over Trump’s blatant profiteering. Senate bills, spearheaded by Chris Murphy, and House walkouts led by Maxine Waters scream corruption—Murphy calling it “the single most corrupt act” by a president. Additionally, Democrats have highlighted how the deal involving an Emirati state-backed fund raises serious national security concerns. The SEC oversight remains crucial as cryptocurrency increasingly intersects with traditional securities markets. Can anyone pretend this isn’t a circus of conflicts?

The crypto industry, desperate for legal footing, watches helplessly as lobbying efforts crumble against this scandal’s weight. Trump’s rollback of Biden-era regulations might dazzle innovators, but at what cost, when his family’s dealings poison legislative trust? The irony bites hard: a supposed visionary for U.S. crypto dominance, yet a saboteur of its regulatory bedrock. This isn’t mere policy clash—it’s a betrayal, a masterclass in prioritizing personal gain over national interest. Moreover, the Working Group, chaired by Sacks, is tasked with providing regulatory clarity within 180 days, yet its efforts risk being overshadowed by these personal conflicts. Will Congress hold the line, or fold under this brazen hypocrisy? The clock ticks, and accountability remains maddeningly elusive.