Cryptocurrency exchange security rests on five essential pillars: multi-factor authentication, cold storage solutions, data encryption, continuous monitoring, and regulatory compliance. Like a digital fortress, these systems work together to protect virtual assets from cyber threats. Time-sensitive authentication codes, offline storage vaults, and AI-powered monitoring create multiple defensive layers. While no system is completely impenetrable, implementing these security measures considerably reduces risks. The deeper one explores these protections, the more their elegant complexity emerges.

As cryptocurrency exchanges continue to handle billions in digital assets, the imperative for robust security measures has never been more critical. Like fortified medieval castles protecting precious treasures, modern exchanges must deploy multiple layers of defense to safeguard their users' digital wealth. At the heart of this security fortress lies Multi-Factor Authentication, requiring users to prove their identity through multiple checkpoints before accessing their accounts. Two-factor authentication remains a fundamental requirement that significantly enhances account security. Popular authenticator apps like Google Authenticator generate time-sensitive codes that expire quickly, adding an essential security layer for crypto transactions.

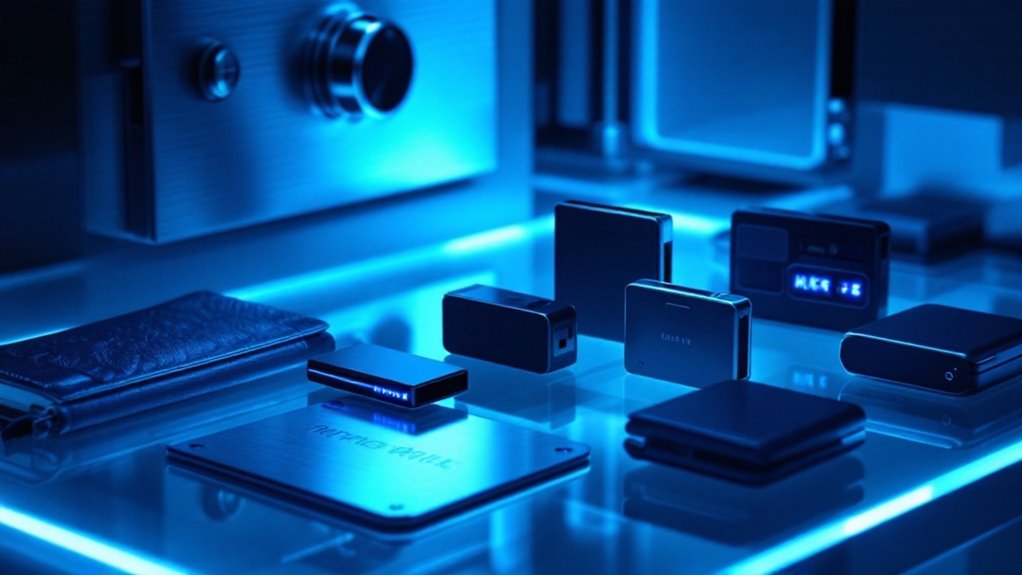

The crown jewels of any exchange – the cryptocurrencies themselves – demand extraordinary protection through cold storage solutions. Picture an underground vault, disconnected from the internet, where digital assets slumber peacefully in multi-signature wallets. These sleeping giants only awaken through carefully choreographed ceremonies involving multiple authorized keyholders, often separated by continents. Strict security standards must be maintained throughout the storage process to ensure maximum protection of user assets.

Digital fortunes rest in arctic vaults, guarded by keys scattered across the globe, awakening only when their guardians unite.

In the digital domain, encryption serves as the invisible shield protecting sensitive data. Modern exchanges employ state-of-the-art encryption algorithms and hardware security modules that would make even veteran cryptographers smile with approval. Like vigilant sentinels, these systems work tirelessly to guarantee that user data remains confidential and untampered.

The exchange's nervous system consists of sophisticated monitoring tools that never sleep. Artificial intelligence algorithms patrol transaction patterns like digital bloodhounds, sniffing out suspicious activities and raising alerts faster than human observers ever could. Meanwhile, dedicated security teams stand ready to respond to threats, their fingers hovering over virtual alarm buttons.

Behind the scenes, exchanges must navigate a complex maze of regulatory requirements while maintaining their security posture. Regular audits serve as health check-ups, confirming that security measures remain robust and up-to-date. Employee security measures act as human firewalls, with strict access controls and continuous training programs creating a culture of security awareness.

Should the unthinkable happen, incident response plans spring into action like well-oiled machines. These battle plans, tested regularly through simulated attacks, guarantee that exchanges can weather any storm while keeping their users' assets safe.

In the ever-evolving landscape of cryptocurrency security, staying ahead means never standing still.

Frequently Asked Questions

How Often Should I Update My Cryptocurrency Exchange Password?

Users should update their exchange passwords every 3-6 months, or immediately following security incidents. Annual updates are acceptable for casual users with strong passwords and two-factor authentication enabled. More frequent changes increase security.

Can I Recover My Funds if My Exchange Account Gets Hacked?

Fund recovery after an exchange hack is possible but not guaranteed. Immediate reporting to exchange support, law enforcement, and documentation of unauthorized transactions increases chances of recovery through reimbursement or asset tracing.

What's the Safest Way to Store API Keys for Trading?

The safest way to store API keys is using Hardware Security Modules (HSMs) with encrypted key storage. Never store keys in plain text. Implement access controls, regular key rotation, and monitoring for suspicious activity.

Are Decentralized Exchanges More Secure Than Centralized Ones?

Decentralized exchanges offer enhanced security through non-custodial design and elimination of central points of failure. However, they face unique risks from smart contract vulnerabilities and require greater technical expertise from users to operate safely.

Should I Enable Sms-Based Two-Factor Authentication for My Crypto Exchange Account?

SMS-based 2FA is not recommended for crypto exchange accounts due to vulnerabilities like SIM swapping and SMS interception. Users should opt for more secure alternatives like authenticator apps or hardware security keys instead.