How long will traditional financial institutions continue to feign skepticism toward cryptocurrencies before grudgingly embracing the inevitable? Bank of America, emblematic of entrenched banking orthodoxy, once dismissed digital currencies as fleeting curiosities, yet now quietly amasses hundreds of blockchain patents, signaling a reluctant pivot. The institution’s cautious engagement with digital wallets and stablecoins underscores a begrudging acknowledgment that cryptocurrencies are not an ephemeral fad but a seismic shift demanding strategic adaptation. Yet, regulatory hurdles remain the convenient scapegoat, a shield behind which legacy banks mask their inertia, delaying genuine innovation under the guise of compliance. Despite these challenges, it is notable that two-factor authentication has become a baseline security measure among leading platforms, highlighting the growing emphasis on protecting digital assets.

This posture reveals a deep paradox: while digital wallets proliferate and consumer demand for seamless, secure digital payments escalates, regulatory frameworks lag, creating a labyrinthine environment that banks exploit to justify their sluggishness. The FDIC’s recent clarifications—that banks may engage in crypto activities without prior approval—expose this pretense, challenging institutions to transcend their self-imposed paralysis. Instead, they cling to risk management protocols as a pretext for inaction, ignoring the fact that blockchain technology’s inherent security enhancements could mitigate many concerns. Bank of America CEO Brian Moynihan has stated that the bank’s infrastructure is ready for future crypto payment integration, highlighting their technical preparedness despite regulatory uncertainty infrastructure readiness. The bank is also closely monitoring regulatory developments to ensure full compliance as it prepares to integrate stablecoins into its payment systems regulatory developments.

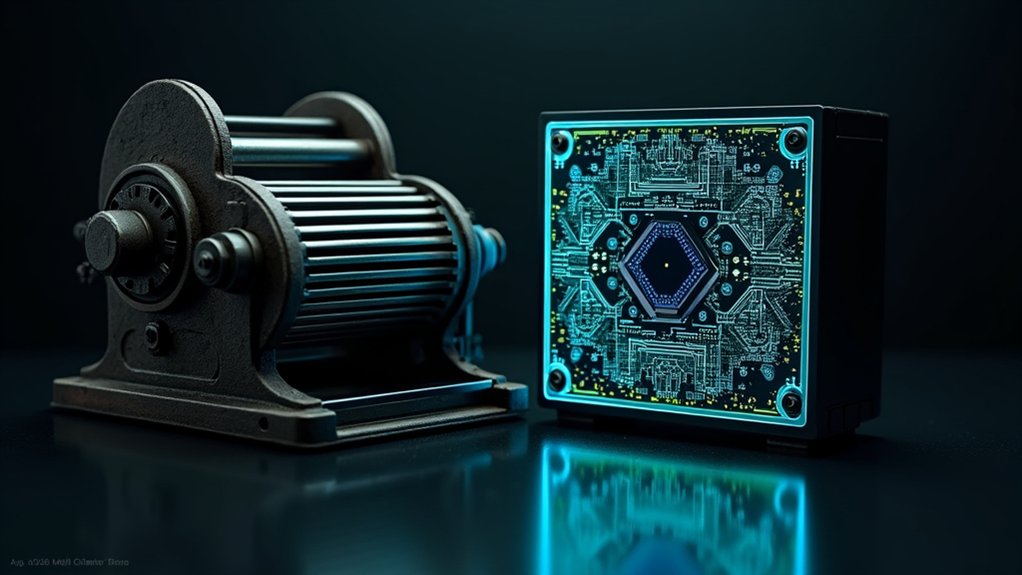

Bank of America’s cautious preparation for stablecoin integration, far from pioneering, is a defensive maneuver aligning with broader industry trends rather than visionary leadership. The bank’s extensive patent portfolio, though impressive, functions more as intellectual insurance than a blueprint for proactive transformation. Meanwhile, Bitcoin’s meteoric rise continues to disrupt market orthodoxies, rendering the printing press comparison not hyperbolic but increasingly apt. In this light, traditional banks must confront the uncomfortable truth: their era of unquestioned dominance is eroding, and only those shedding regulatory excuses and embracing blockchain’s potential will survive the digital revolution.